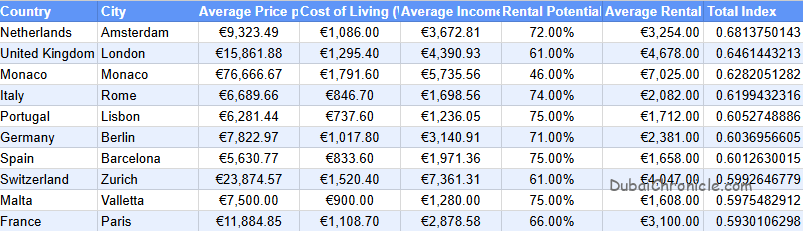

- A brand new research ranks the very best locations to buy property in prime areas primarily based on metrics similar to property costs, rental costs, rental occupancy charges, value of residing, and common earnings.

- Amsterdam tops the record for property funding in prime areas with the best whole index robust rental potential with a 72% occupancy fee.

- Monaco ranks third with having the best rental and sale costs among the many high cities.

- Barcelona has the bottom property worth per sq. meter and has a excessive occupancy fee of 75%.

Cryptorush performed an in-depth evaluation of 100 cities throughout Europe to find out the very best locations to buy property in prime areas. The rating is predicated on a complete index that considers a number of key components: property costs, rental costs, rental occupancy charges, value of residing, and common earnings. To create the index, information was collected on the common worth per sq. meter for properties in essentially the most fascinating areas inside every metropolis, in addition to rental costs for an 85m² house and the rental occupancy fee in these prime areas. The value of residing and common earnings have been included to grasp the financial setting of every metropolis. Each issue was weighted to calculate a complete index rating for every metropolis, which helped rank them from essentially the most to least enticing for property funding.

Here are the outcomes summed up:

Monaco ranks third with a complete index of 0.628. It has the highest rental and sale costs among the many high cities, pushed by its unique and fascinating areas. Property costs are extraordinarily excessive at €76.6K per sq. meter, and the rental occupancy fee is decrease at 46%. Substantial rental earnings potential makes Monaco a worthwhile place to spend money on luxurious properties.

Rome is fourth with a complete index of 0.620. Property costs in prime areas are comparatively reasonably priced at €6.6K per sq. meter, coupled with a excessive rental occupancy fee of 74%. Rental costs are average at €2K, and the price of residing is decrease. Rome gives a balanced funding alternative, making it enticing on account of its robust rental potential at cheap prices.

Lisbon ranks fifth with a complete index of 0.605. The metropolis options reasonably priced property costs in prime areas at €6,2K and a excessive rental occupancy fee of 75%. Having decrease rental costs at 1.7K, Lisbon’s general affordability and excessive rental demand make it a powerful contender for funding in metropolis heart properties.

Berlin is available in sixth with a complete index of 0.604. Property costs in prime areas are €7.8K per sq. meter, with a excessive rental occupancy fee of 71% and average rental costs at €2.3K. The metropolis’s first rate common earnings balances the funding prices, making Berlin a aggressive marketplace for prime property funding on account of its balanced prices and robust rental potential.

Barcelona is seventh with a complete index of 0.601. Property costs in prime areas are at €5.6K per sq. meter, and the town enjoys a excessive rental occupancy fee of 75%. This mixed with rental costs of €1.6K, make Barcelona a sexy funding choice for prime space properties on account of its excessive rental demand and cheap prices.

Zurich ranks eighth with a complete index of 0.599. Property costs are excessive at €23.8K per sq. meter in prime areas, and the price of residing is important. However, Zurich’s excessive common earnings at €7.3K and rental costs at €4K in prime areas justify the funding. The rental occupancy fee is 61%, supporting Zurich’s profitability for buyers focusing on prime properties with robust rental potential.

Valletta takes the ninth spot with a complete index of 0.598. The metropolis gives property costs of €7.5K per sq. meter in prime areas and a excessive rental occupancy fee of 75%. Rental costs are decrease than in the remainder of the highest cities at €1.6K however the decrease value of residing and common earnings make funding prices manageable.

Paris rounds out the highest ten with a complete index of 0.593. Property costs in prime areas are excessive at €11.8K per sq. meter. The metropolis gives a average rental occupancy fee of 66% and substantial rental costs of €3.1K. With excessive rental costs and an common earnings of €2.8K supporting these prices, Paris turns into a compelling funding vacation spot for prime properties on account of its important rental earnings potential.