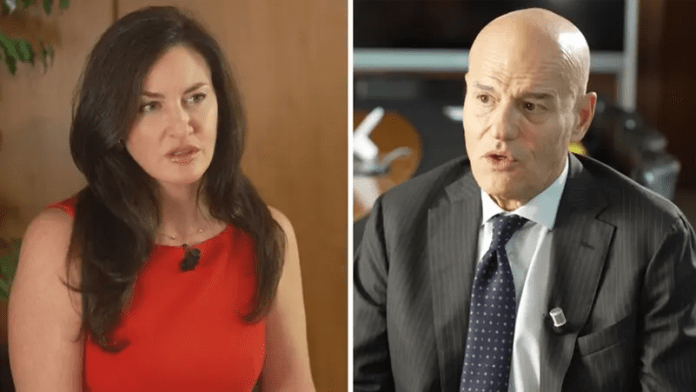

In an interview with Al Arabiya’s Hadley Gamble, ENI’s CEO Claudio Descalzi dispelled the notion that oil costs would possibly hit $100 by the year-end regardless of escalating tensions within the Middle East.

“The market, at the moment, does believe that [the bombing of the Iranian oil facilities] can happen. That is my feeling”, he instructed Gamble.

Last week oil markets moved on feedback from U.S. President Joe Biden suggesting an assault on Iran’s oil amenities was beneath dialogue. Oil costs right this moment stay elevated regardless of the white home later strolling these feedback again.

“That is dangerous, not just for the price. This is dangerous for a worldwide war… That is a is a clear, strong statement, a strong event”, Descalzi stated.

Weighing in on the precise impact such hypothesis had on oil, he stated it might pump up costs, however in a restricted vary. “We see their action was not so strong from a price point of view. Because if you pass from 74 to 79, or $78 that means that, okay, there is some fears. And you know, they use also algorithms. So this kind of statement can create in the algorithm the feeling to buy, buy, buy… But that means just a few dollars at the end of the day.”

Despite a “very volatile” oil market, Descalzi stated demand is there. “At the moment we are about 103 million bar per day of demand, and by 2025, 104 million barrels per day. So the demand is there.”

Gamble quizzed the oil boss on the probability of oil costs reaching the $100 mark by the tip of the 12 months, given the unstable geopolitical panorama. Descalzi responded with cautious optimism concerning the stability of the market, saying, “No, I don’t think so, because we are still in a situation where it’s not clear what’s going to happen with the central banks in Europe in terms of reduction of interest. We saw in the US, 50 points is huge, so a huge reduction.”

Descalzi additionally highlighted the position China performs in international power consumption, thereby instantly impacting oil market forecasts. “I think that we have to understand how the growth is going to happen in China, because China, in any case, represents 25% of the consumption overall, with India as well”, he stated.

A major a part of the dialogue targeted on the challenges and inadequacies within the upstream funding, posing a danger to future oil provide, probably resulting in increased costs if not addressed.

“The supply, in terms of investment for the upstream, are not really matching this kind of growth in demand. There is no big project. There is no a lot of investment in the upstream,” Descalzi identified.

“We are still investing less than in 2013 for example. So we are not able to replace the natural depletion of the field. We don’t have enough investment in new fields. There are a lot of m&a, but that means that we are not creating new reserves or new production.” Descalzi stated. “So there is this gap.” He added.